TLDR (Too Long Didn’t Read):

Spark the wonder of Yin-Yang Candlestick Strategy Trading—a captivating blend of ancient wisdom and modern techniques. Wickler also speaks. Wicks are the only thing that matters in this candle plan. I explained with examples how to determine the Entry, Take-Profit, Stop-Loss points and in what situations to use them. It’s time to embrace balance and boost your success!

What is the Yin-Yang Pattern Trade Strategy?

First things first, let’s get our basics right. Yin-Yang system is a subset of candlestick patterns used by Forex traders to analyze price movements. They derive their name from the concept of balance and opposition, much like the Yin-Yang symbol from ancient Chinese philosophy.

Much like it symbol representing balance and harmony, these patterns offer insights into market sentiment and potential reversals. It offers a visual representation of price movements and investor sentiment.

In trading terms, ‘Yang’ often represents bullish or upward trends, while ‘Yin’ symbolizes bearish or downward trends. It is a pattern consisting of two consecutive candles of the same color.

The wicks of the candles are important to us. The bodies of the candles are not considered.

| Key Point | Description |

|---|---|

| Yin-Yang Pattern Definition | A Forex trading candlestick pattern reflecting balance and opposition, similar to the Yin-Yang symbol in Chinese philosophy. |

| Pattern Types | Two types: Bullish (two rising candles) and Bearish (two falling candles), each with specific wick and body characteristics. |

| Trading Strategy | Involves identifying these patterns and trading in the direction of the trend following the closure of the second candle. |

| Entry, Stop-Loss, Take-Profit | Entry at the trend direction after the second candle, with specific stop-loss and take-profit strategies based on the candles. |

| Common Misconceptions | These patterns are not rare, overly complicated, or specific to certain markets; they require proper risk management. |

| Trading Tips | Effective in trend directions post-breakouts, and should be combined with price action analysis for better decision-making. |

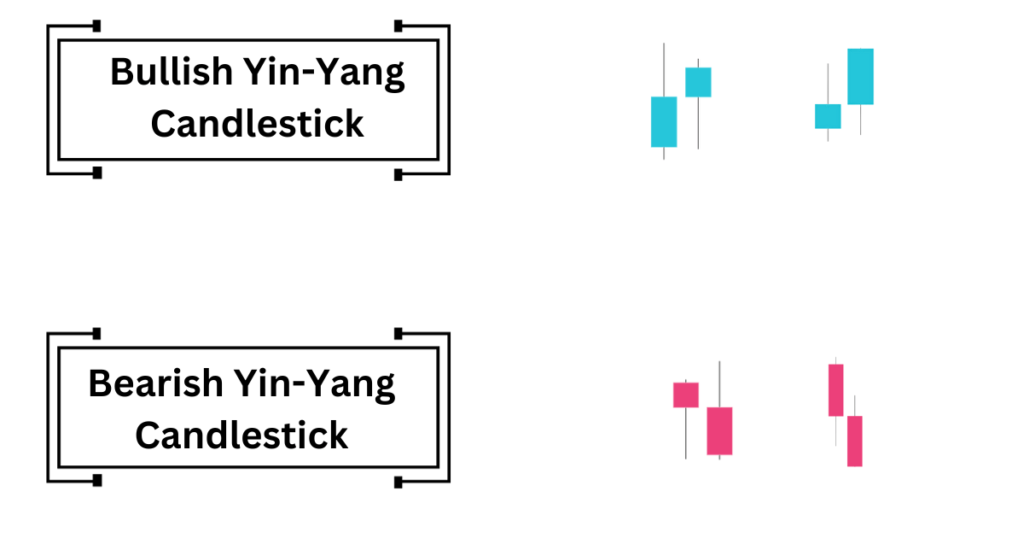

Types of Yin-Yang Candlestick:

There are two types: Bearish and Bullish. It’s time to explore this further.

Bullish Yin-Yang (for long):

You need to identify two rising candles. The first bar should have a long upper wick and a short lower one. This suggests that the price spiked but quickly fell, indicating a level has been cleared, triggering sell orders or ending sellers.

Next, the price should descend towards the body of the first bar, gathering buy orders to create a second rising bar. Unlike the first, second candle should have a short upper wick and a long lower one.

Bearish Yin-Yang (for short):

You need to spot two falling candless. The first bar should have a short upper wick and a long lower one. This suggests that the price dipped but quickly rebounded, indicating a level has been cleared, triggering buy orders or ending buyers.

Next, the price should climb towards the body of the first bar, gathering sell orders to create a second declining bar. Unlike the first, second candle should have a long upper wick and a very short lower one.

How to Trade Using the Yin-Yang Candlestick Strategy?

This formation is quite simple but requires some patience, observational skills and above all, practice.

Now, let’s delve into the “How” and equip you with the knowledge and skills to effectively use Yin-Yang Patterns in your trading system:

Entry: Enter the trade in the direction of the trend as soon as the second candle closes.

Stop-Loss (SP):For a long position, the end of the lowest wick of the first candle is the ideal stop position. Conversely, for a short position, the end of the top wick of the first candle is suitable.

Take-Profit (TP): For the target can be set equal to the total length of the two candles. Afterwards, half of the trade can be closed and a trailing stop can be used.

However, setting a TP arbitrarily wouldn’t make sense, our target should always be points that are in line with the Price Action structure.

Profitable Examples of the Yin-Yang Candlestick:

Top 6 Tips for Trading the Yin-Yang Candlestick:

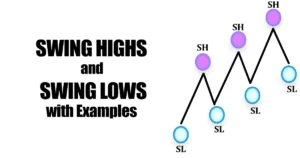

- It is more effective if it occurs in the direction of the trend.

- There is no problem if the long needle of the second candle passes the needle of the first bar.

- If the pattern appears in a flip zone, you should be careful. At this point, the risk of your trade may increase. It may go the opposite way you think.

- These patterns enable you to identify precise entry and exit points, enhancing your risk management strategies.

- When combined with Price Action analysis, Yin-Yang patterns provide a holistic view of market dynamics, empowering you to make well-informed decisions.

- By recognizing these patterns, you tap into the collective psychology of traders, giving you an edge in predicting market movements.

See Also: Marubozu Candlesticks: The ‘Bald’ Truth of Trading

Common Misconceptions When Trading with Yin-Yang Candlestick:

- Yin-Yang patterns are rare and hard to find.

This is not true, they occur frequently in all time frames and markets. You should learn how to recognize them visually by looking at the color, size, and shape of the candles. - Yin-Yang patterns work better in certain markets or time frames.

This is not true, they reflect the psychology of the traders and the supply and demand of the market so they work well in any market or time frame, as long as there is enough liquidity and volatility. - Yin-Yangs do not have a high success rate and low risk.

This is not true, they are not magic bullets or holy grails that guarantee profits or prevent losses. They are probabilistic and statistical tools that give you an edge over the market, but they also have limitations and drawbacks. You should always use proper risk management and money management when trading with them. - This pattern is complicated and confusing.

This is not true, it is easy to learn and apply. - The method is very simple, I Don’t Need a Plan; I’ll Wing It!

This is not true. The wing-it warriors, the ones who believe they can stroll into the trading arena like a gunslinger from an old Western movie.

Well, let me tell you, trading without a plan is like trying to navigate a maze blindfolded – you might stumble upon the exit, but the odds aren’t in your favor. A well-thought-out trading plan is your map through the labyrinth of the market. Without it, you’re lost.

Conclusion:

This guide has unveiled the power of Yin-Yangs in Forex trading, highlighting their role in Price Action analysis and trading success. When you combine price action with that candlesticks, you get a potent mix that can supercharge your trading scheme.

Trading is a bit like playing chess with a cosmic grandmaster – you can’t predict their moves, but with practice and technique, you can hold your own. The market is a beast with a taste for the unexpected, but armed with knowledge and a dash of courage, you can navigate its twists and turns like a true pro.

Remember, no two patterns are the same. They are as unique as your trading journey. So don’t get disheartened if you don’t spot them immediately.

Keep at it and soon you’ll start seeing them everywhere! If the wicks caught your attention, don’t miss the tips of the Pin Bar model in your exploration journey.

Success in trading is not about predicting the future, but rather understanding the present.

– Stephen Hoad

FAQs:

Is it safer than other candlestick patterns?

This varies from person to person. For me, the answer to the question is no, I prefer trading the safer Inside Bars.

How do traders use this method in their strategies?

Traders use these patterns to identify potential trend continuations. They may enter or exit positions based on the specific patterns observed and their associated meanings.

Are they similar to Engulfing bars?

Frankly, it’s something completely different. Engulfing Candlestick Pattern includes two bars in price chart. Subsequent candle is much longer and ‘absorbs’ all previous one.

Are there any specific market conditions where this tactic?

You should focus on the trend, it is ideal for the trend direction that occurs after the breakouts.

Are there any risks associated with this technique?

Yes, like any trading approach, there are risks involved. False signals can occur, leading to losses. Traders should also be aware of market volatility, risk management and the importance of a well-defined trading plan when using it.

Brian Miller is a Forex trader who uses price action, a method based on real prices instead of indicators. He learned this technique from hedge fund experts and has been trading full-time since 2011. He has a finance degree and writes about Forex on various websites. On this website, he shows his price action system and how it works in different markets.

![What is an Engulfing Candlestick Pattern & How to Find One [+Examples] Smart Trading Making-Money with Engulfing-Candlesticks Examples](https://priceactiontradingchart.com/wp-content/uploads/2023/10/Smart-Trading-Making-Money-with-Engulfing-Candlesticks-Examples-300x158.webp)