TLDR (Too Long Didn’t Read):

MSB are amazing reversal patterns that signal a change in the direction of the market. They are easy to spot, easy to trade, and can give you huge profits if you know how to use them. This guide will teach you everything about MSB, from what they are, to how to find and trade them with a simple and effective strategy. You will also see some real MSB trades, with the best entry, take-profit, and stop-loss levels. You can check the FAQs at the end of this guide.

| Key Point | Summary |

|---|---|

| What is a Market Structure Break (MSB)? | A break of an important swing high or low in the market structure that indicates a potential change in trend. |

| How to Identify MSBs | Look for a break of the most recent swing high in downtrend, or swing low in uptrend. This signals potential trend change. |

| How to Trade MSBs | Buy when price breaks above swing high, placing stop below recent structure. Sell when price breaks below swing low, with stop above structure. |

| Types of MSBs | Intraday MSB for short-term trades. Daily/weekly MSB for larger trend trades. |

| Using MSBs | Signals possible trend reversals early. Defines new key support and resistance levels. Provides trade entry and stop loss points. |

| Limitations | Not all MSBs result in full trend reversals. Need confirmation from other indicators. Be aware of false breakouts. |

What is the Market Structure Break Trade Strategy?

Market Structure Break (MSB), as its name suggests, is the name given to the break that appears at the end of a trend. It is an important topic of Price Action, it gives you the beginning of the price. Understanding the market is understanding the price. Understanding the price means ensuring consistent success.

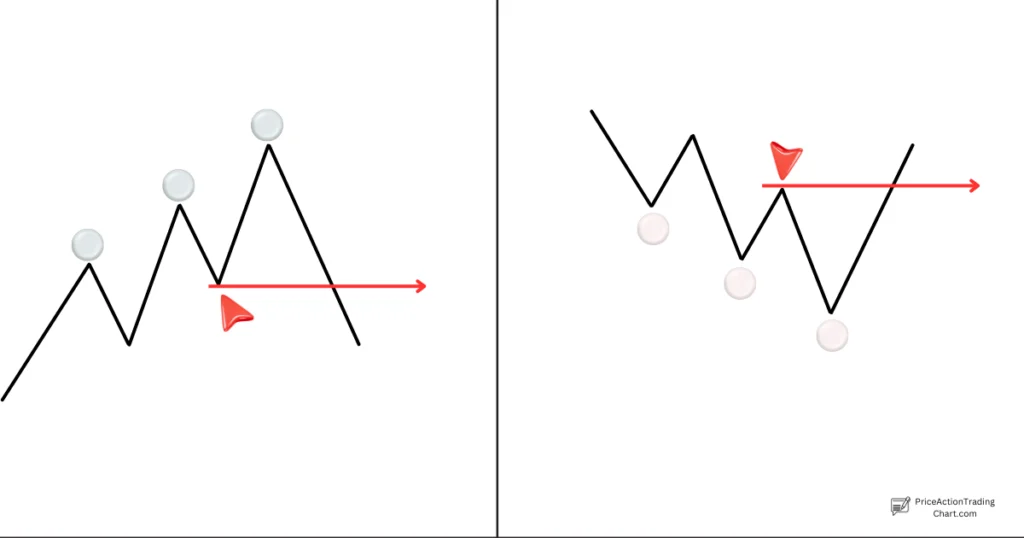

Whichever chart we open, we see that the price continues with a cycle specific to that chart. It goes up and down, rests and resets the order again. Here, the market’s strong downward or upward trend begins to weaken at some point and the trend is broken.

In other words, Higher High Lower Lows ultimately end with a breakout. We traders may have endless soul desire, but trends cannot continue forever.

From Zero to Hero:

How to conquer the Forex market? This is your story. A story of how you can go from being a clueless newbie to a confident master of the forex market.

Sounds too good to be true, right? Well, it’s not easy, but it’s possible. You will have your fair share of blunders and losses, but you will never give up.

You will be eager to learn the secrets of Price Action, the art of reading the market’s movements. And once you do, everything will change. You will start to apply what you learn to your own trading style, and you will see the results.

You will realize that trading is not just about following some rules; It’s about expressing yourself through the market. It’s about finding your own voice.

How to Identify Market Structure Breaks:

There are a few key things to look for when identifying market structure breaks:

A clear and strong break of support or resistance: The price should break through the support or resistance level decisively, without any hesitation.

A break of a trend line or a channel that has been holding the price for a long time.

Confirmation: Once the price breaks through the support or resistance level, it should continue to move in the direction of the break. This confirmation can come in the form of a series of higher highs or lower lows.

Candlestick patterns: A strong and decisive candle that closes beyond the support or resistance level, such as a bullish engulfing or a bearish engulfing candle.

Types of Market Structure Breaks:

There are two main types of market structure breaks:

The Bearish Market Structure Break:

These occur when the price creates a higher high on an uptrend without first creating a lower low. This signals that the uptrend is likely to continue.

The Bullish Market Structure Break:

These occur when the price creates a lower low on a downtrend without first developing a higher high. This signals that the downtrend is likely to continue.

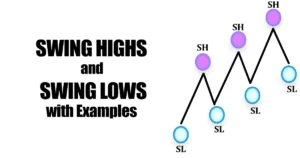

See Also: Swing Highs Swing Lows

How to Trade Market Structure Breaks?

Let me tell you a secret. One of the biggest hurdles that forex traders have to overcome is how to handle market structure breaks. You know, those moments when the market price decides to change its mind and go the other way.

How do you deal with those? Well, once you spot a possible market structure break, you can jump on it by opening a trade in the direction of the break.

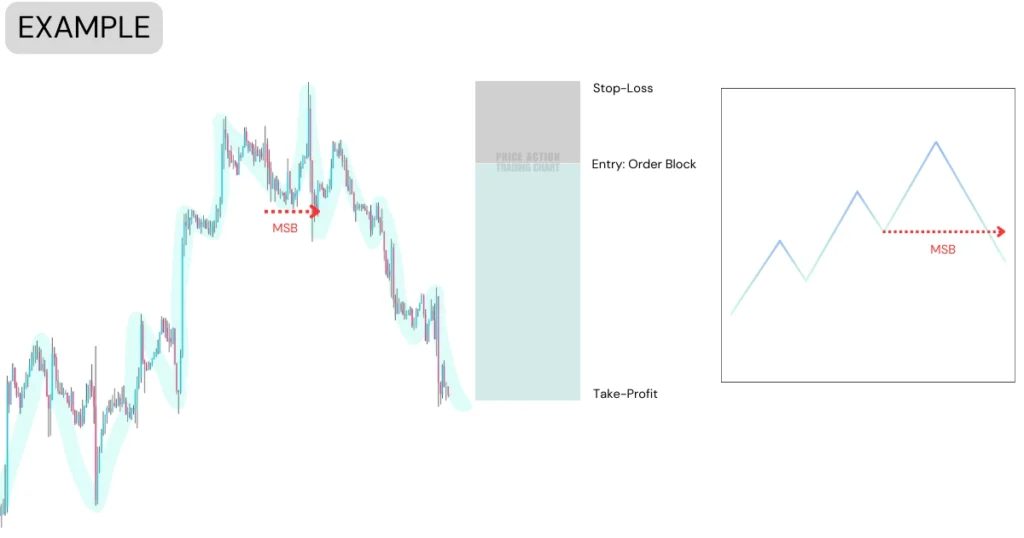

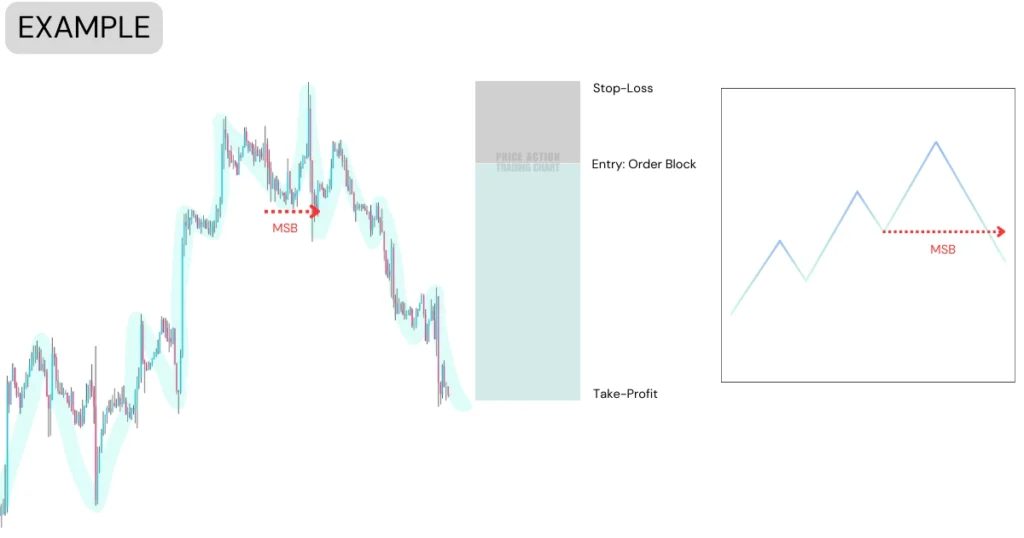

For instance, suppose we have a downtrend on the daily chart. The price suddenly breaks above a major resistance level and stays there. This could be a sign that the market structure is breaking and the trend is reversing.

There are two main ways to trade a market structure break: breakout and pullback strategy.

– Go with the trend: Breakout strategy is when you jump into the trade as soon as the price breaks the support or resistance level, hoping for a continuation of the move in the same direction. This strategy requires a quick and bold entry, as well as a tight stop loss and a trailing stop to secure your profits.

– Wait for the pullback: This is when you wait for the price to revisit the broken support or resistance level, which now acts as a flip zone, before entering the trade in the direction of the break. This strategy requires more patience and confirmation, as well as a wider stop loss and a fixed target to catch the swing.

Zoom in to a lower timeframe and look for fair value gaps and order blocks in the direction of the MSB. For example, if you have spotted a bullish MSB on the daily chart, look for bullish fair value gaps and order blocks on the 4-hour or 1-hour chart. These will act as your entry points for buying.

These breaks can be observed across different time frames, from short-term to long-term trading, whether intra-day, swing, or position.

Successful traders combine their understanding of market structure with sound risk management practices and disciplined execution to look for signs of exhaustion in existing trends before entering trades in the opposite direction.

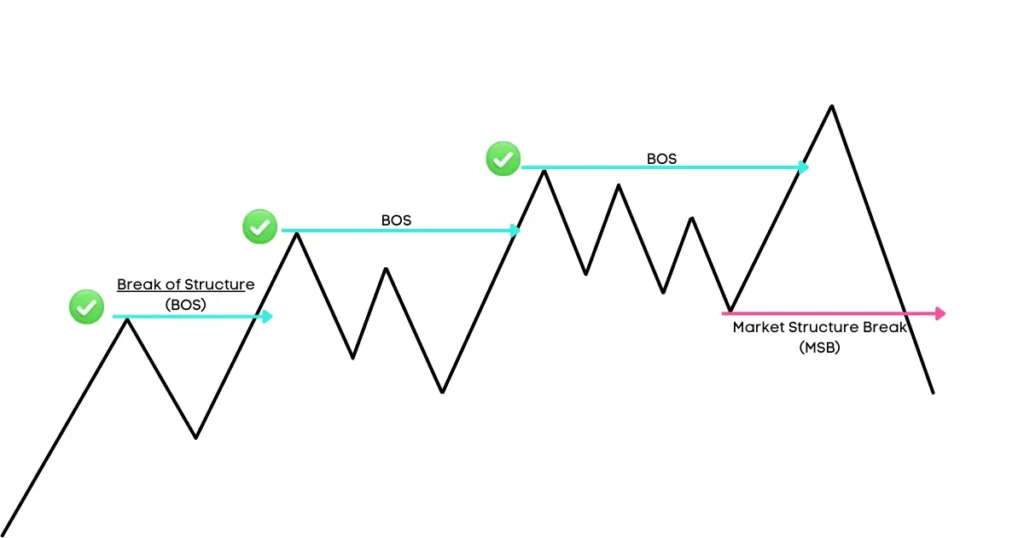

What’s the Difference Between MSB and BOS?

What we call Break of Structure (BOS), are new breaks that continue in the direction of the trend. For example, in a rising trend, new highs continue by breaking the previous high, this is BOS.

It adds strength to the trend. MSB is a break in the opposite direction of the current trend and occurs when the trend is weak. Here is an example:

Profitable Examples of the Market Structure Break:

Top 6 Tips for Trading the MSB:

- Use multiple timeframes to confirm the break.

- Look for a strong confirmation candle after the break.

- News Flash – Be In the Know: Stay in the loop with market news, ’cause it can spark those market structure fireworks.

- No more blind leaps of faith. Combine with other PA concepts to confirm the break and trend direction. It’s essential to ensure compatibility and avoid conflicting signals.

- Plan Your Entry and Exit: Be the commander of your trades, with a strategy that lets you in and out at the right moments.

- Luck is for the lottery; trading’s about skill. Practice makes perfect, so backtest your market structure break strategies across different markets and timeframes. Find your trading soulmate – the one that syncs with your style and personality. This is your ticket to becoming a confident and consistent trader.

Common Misconceptions When Trading with MSB:

- False Breaks:

Ever tried driving blindfolded? Probably not – it’s a recipe for disaster, just like blindly jumping into a market break. Take a breath, and analyze your surroundings. To dodge false breaks, look for a clear break of a key level. Think of it as finding a treasure map and following the “X” with utmost clarity. - Impatience:

In a world where instant noodles and lightning-fast internet exist, patience seems like an old-fashioned virtue. But trading isn’t the fast-food lane; it’s more like a gourmet meal that takes time to cook. Rushing can lead to decisions you’ll later regret. So, don’t be a hasty trader; trust your gut and let your trades marinate like a fine wine. - Neglecting Backtesting:

Ever bought a fancy gadget only to realize it’s all show, no substance? Neglecting backtesting is like that. Before you put your real money on the line, you gotta test the waters. Dive into historical data and see how your strategy swims. It’s like a dress rehearsal for a high-stakes play, building your confidence and refining your moves.

Conclusion:

So, summing it all up, Market Structure Breaks are the backbone of Price Action. They show you when the market price breaks a support or resistance level, which means that the market mood has changed and a new trend might start.

You can understand the concept more easily with this video that offers an easy explanation.

By using higher timeframes, waiting for confirmation, finding entry points with fair value gaps and order blocks, managing risk with stop loss and target, and practicing and testing your strategies, you can rock the Market Structure Breaks and become a better trader.

Stay disciplined, craft a rock-solid game plan, and you’re well on your way to success. Don’t forget, it’s a wild ride, but you’ve got this!

FAQs:

Are there any specific candlestick patterns that often accompany Market Structure Breaks?

That’s what Reversal Candlestick Patterns are for. (e.g., engulfing candlesticks, pin bar strategy, inside bar strategy)

How can I use market structure breaks to trade news events?

Dealing MSBs during news events can be risky due to heightened volatility. It’s best to avoid entering trades right before major announcements.

Instead, wait for the initial market reaction and then look for MSBs that align with the new sentiment. Use wider stop-loss orders and lower position sizes during news events to mitigate risk.

How do market structure breaks differ across various currency pairs?

Each currency pair has unique characteristics ,different levels of volatility and liquidity, which can influence the frequency and magnitude of market structure breaks.

Familiarize yourself with the specific behaviors of the currency pairs you trade to adapt your strategy accordingly.

What is the difference between a false break and a true market structure break?

A true MSB is a legitimate shift in market sentiment, leading to a sustained price movement. A false break, on the other hand, initially appears as the MSB but reverses quickly, trapping traders.

Distinguishing between the two requires careful analysis and confirmation signals. Look for the same trend break in a lower time frame. Low time starts the flame, high time turns it into a fire.

Are there any software tools or indicators that can aid in the identification of MSBs?

If you want to use various indicators from code-savvy traders, Tradingview website is ideal for that. You can find them in the indicators section. The ones chosen by the editor are more reliable.

Can MSB Guarantee Profits?

No trading strategy can guarantee profits. MSB, like any approach, carries risks. Success depends on your skills, discipline, and market conditions. In this journey of endless twists and turns, one thing is your trusty sidekick – the stop-loss order.

📌 It’s like the insurance for your market adventure, saving your hard-earned bucks when those sneaky false signals come knocking. Always trade responsibly and be prepared for both wins and losses.

Brian Miller is a Forex trader who uses price action, a method based on real prices instead of indicators. He learned this technique from hedge fund experts and has been trading full-time since 2011. He has a finance degree and writes about Forex on various websites. On this website, he shows his price action system and how it works in different markets.