TLDR (Too Long Didn’t Read):

Blind Spot is a price action trading strategy that uses a momentum candlestick and strong break lines to identify hidden trading opportunities. It can help you spot trend reversals, breakouts, and pullbacks with high accuracy. In this post, you will learn what Blind Spot is, how it works, and how to apply it to your own trading. Plus, you will see a real example of a BS setup with entry, take-profit, and stop-loss levels at the end of the post.

| Key Point | Summary |

|---|---|

| What is the Blind Spot Strategy? | A price action strategy that trades breaks and rejections of the prior day’s high and low. |

| How to Identify Blind Spots | Look at yesterday’s price action and mark the high and low points. These become blind spots. |

| Trading the Blind Spots | Buy breaks above yesterday’s high. Sell breaks below yesterday’s low. Fade rejections. |

| Why Trade Blind Spots? | Marks significant support/resistance levels. Clearly defines trade triggers. |

| Using the Blind Spot Strategy | Works well for day trades and scalping setups. Combines with other indicators. |

| Limitations | Blind spots not always strong S/R levels. Price can trend away from levels. |

What is the Blind Spot Strategy?

The Blind Spot, (known as BS) is not your typical trading method filled with indicators and complex algorithms. Instead, it’s a pure price action strategy that relies on observing market movements and understanding the psychology of traders.

It refers to a unique price action pattern that often goes unnoticed by many traders. This pattern is characterized by sudden shifts in market sentiment, creating potential trading opportunity.

The Blind Spot strategy has two main rules:

- When the price breaks a support or resistance level, it should do so decisively, strongly, and clearly.

- When the price crosses the line, it should form a large candle with high volume. (For example, a Maribozu Candlestick)

Hidden Base Strategy may look like the same thing, but it has its own unique rules. By mastering both concepts, you will gain a huge advantage in the market.

Types of Blind Spot Concept:

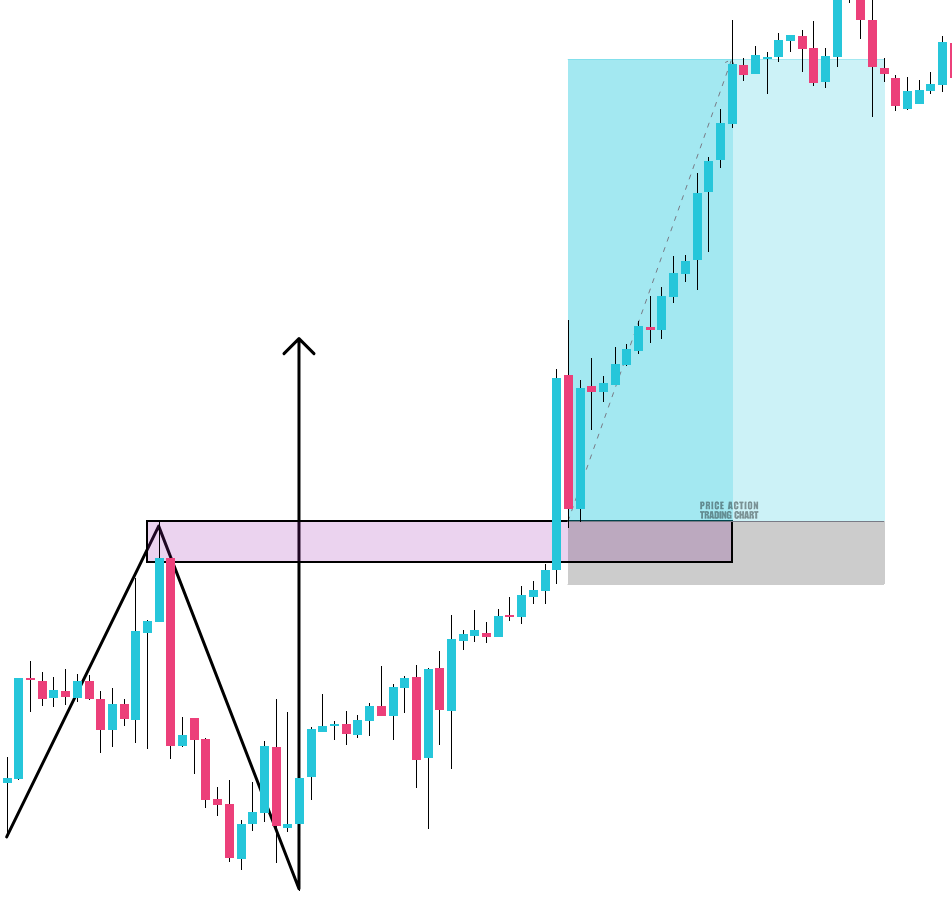

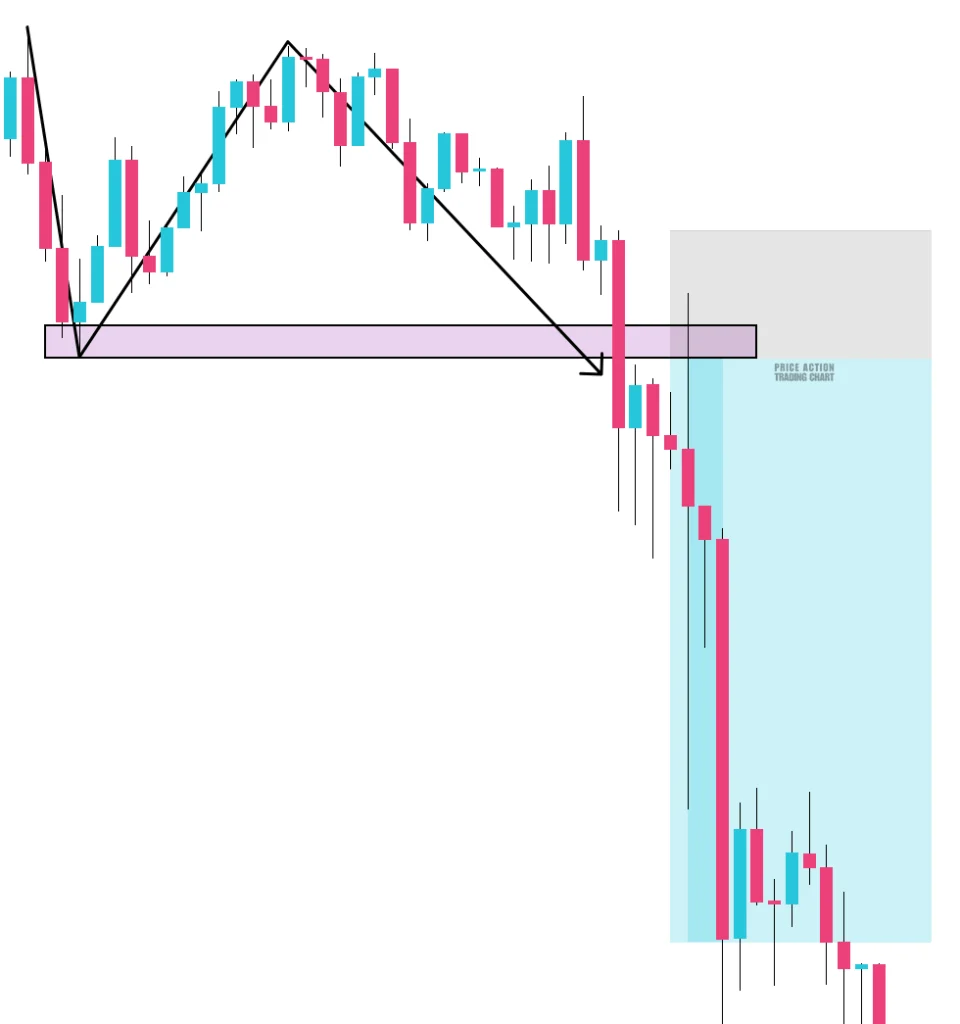

This strategy has two types: one that breaks a rising structure and one that breaks a falling structure. Based on this, we enter the trade from the supply and demand zones that they form.

How to Trade Using the Blind Spot?

Now that we’ve grasped the basics, let’s see how to apply the strategy effectively:

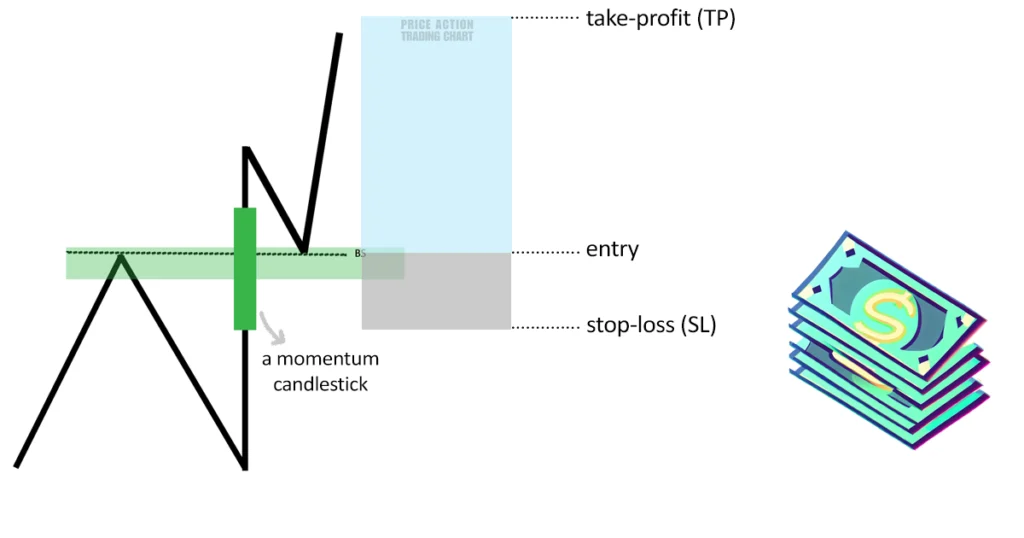

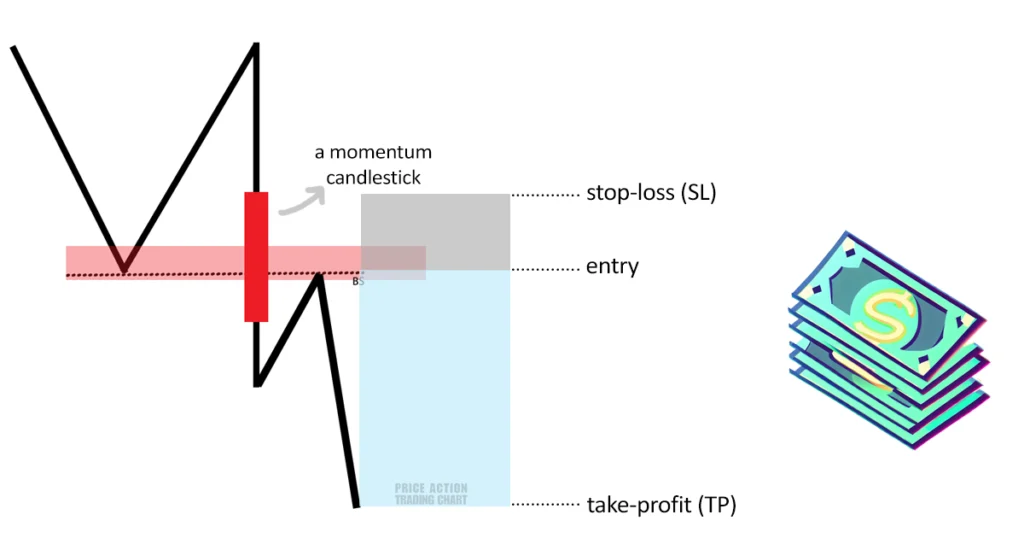

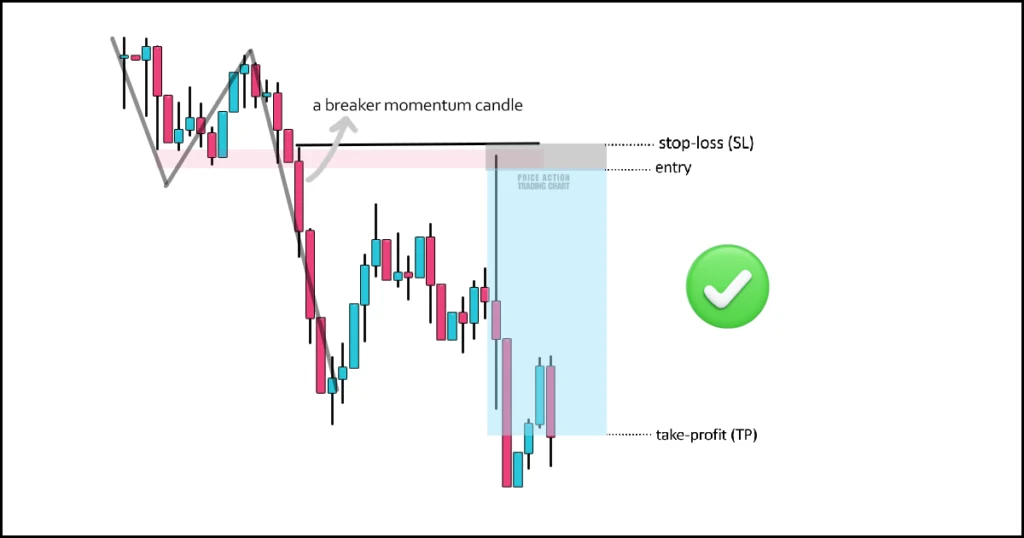

- You need to look for a momentum candlestick that form near the support or resistance levels. This candle indicate potential breakouts or corrections.

- You need to draw lines that connect the previous highs and lows of price movements. These lines act as potential barriers for price movements.

Entry: From our flip zone, we prefer to enter the trade from the edge of the zone created by the wicks.

Take-Profit: A good way to take profit is to use the first swing point that forms after the breakout. Alternatively, we can aim for a supply/demand zone. If you prefer, you can also use a trailing stop-loss to secure your profits. The choice is yours.

Stop-Loss: The stop point is where the momentum candle closes. We choose the momentum candle as our stop point, even though it is riskier, because the previous swing’s end would make the stop point too far.

📌A better way to understand the concept is to watch this video.

Profitable Examples of the Blind Spot:

In this example, the Blind Spot strategy allowed you to enter a trade at an optimal point, manage your risk, and secure a profitable outcome.

Long example: As you can see, the price breaks the top of the previous downward direction with a clear and strong candle.

This is our signal to enter the trade. We use the supply zone created by the wicks above the previous swing as our entry point. Since these trades move fast, I use market orders. The stop point is just below the big candle.

Short example: The price breaks the bottom of the previous upward direction with a clear and strong candle. This is the kind of candle we are looking for, with a large body.

This is our signal to enter the trade. We use the point where the swing flips as our entry point. The stop point is at the top end of the big candle.

See Also: Premium and Discount | PD Arrays Strategy

Top 6 Tips for Trading the Blind Spot:

- When breaking support/resistance, swing lengths are not important. One can be shorter or longer than the other. Do not expect regular lines from here.

- Practice Makes Perfect: Like any skill, mastering the strategy takes practice. Start with a demo account to build confidence.

- Stick to Your Plan: Develop this trading plan and adhere to it religiously. Avoid impulsive decisions.

- Stay Informed: Keep an eye on economic events and news that could impact your trades.

- Embrace Patience: Trading is a marathon, not a sprint. Don’t rush into trades; wait for the “Blind Spot” pattern to confirm.

- This concept is not a reliable reversal signal, although it can occur at the peaks and troughs of price movements. However, based on my trading experience, I have found that it performs better in sideways markets or during trend continuations.

Common Misconceptions When Trading With the Blind Spot:

- Ignoring Market Context:

The strategy is powerful, but it’s not foolproof. Always consider broader market conditions. - Overcomplicating Analysis:

Don’t overanalyze. Stay on the principle of simplicity. - Guaranteed Profits:

Sorry to break it, but there’s no secret sauce in price action that guarantees profits. It’s a skill, not a magic trick. Follow the rules, be patient for that candle. - BS concept is easy and quick:

Yes, it is easy to understand but don’t expect to become a pro overnight. Be patient, grasshopper.

Conclusion:

Blind Spot is not a classical or conventional method, but an original and effective one that I have tested myself over many years of trading forex.

It is based on my personal experience of failing many times before I mastered it, and gaining confidence and consistency by applying it to my own style and risk management.

I hope you enjoyed this methot and learned something new about Price Action.

I encourage you to not give up on trading and to practice Blind Spot with backtesting and real examples. You will be amazed by how it can improve your trading performance.

Remember, price action trading is a skill that you can develop over time. It’s not about shortcuts or magic spells. Bust these myths, stay grounded, and keep learning to become a better trader. 📈💪🧠

FAQs:

Is the “Blind Spot” strategy suitable for beginners?

This strategy may not be suitable for everyone. Even though it is easy to understand, it involves a high level of risk. It is more appropriate for traders who have some experience in trading.

Can I use the Blind Spot strategy for other markets besides Forex?

Yes, you can use it on any market that you prefer. However, I recommend using it on major currency pairs, as they tend to have more liquidity and volatility.

How often do Blind Spot patterns occur?

The frequency of these patterns varies, but they can be found more often in low time frames.

How can I avoid false or weak signals with Blind Spot?

No strategy is foolproof, so you need to be careful with your risk management and practice until you master it.

Brian Miller is a Forex trader who uses price action, a method based on real prices instead of indicators. He learned this technique from hedge fund experts and has been trading full-time since 2011. He has a finance degree and writes about Forex on various websites. On this website, he shows his price action system and how it works in different markets.